Personal Finance Illustrated® Homeschool Edition from PEM LIFE Review

Disclaimer: I received a FREE copy of this product through the HOMESCHOOL REVIEW CREW in exchange for my honest review. I was not required to write a positive review nor was I compensated in any other way.

The course is intended as a single semester course. This has enough material to be used as a high school credit if you use the full course. There are a total of 15 Core Units. When you look at the units in your dashboard you will see 18 Units in the course. The other 3 are introductions and other useful information using the course. 30 Financial Calculators to enhance your lessons throughout the units. The course is a from a Biblical Worldview perspective that is rich in the context of the curriculum.

An overview of the units:

Unit 2: Time Value of Money

Unit 3: Lifetime Capital Potential

Unit 4: Opportunity Cost

Unit 5: The Tax Filter

Unit 6: Lifestyle Regulator

Unit 7: Temperament & Financials

Unit 8: The Importance of Protection

Unit 9: Debt-What Is It, What Is It Not

Unit 10: Pay Cash or Finance?

Unit 11: The Investment Tank

Unit 12: The Saving Tank

Unit 13: Access to Capital

Unit 14: Qualified Plans

Unit 15: Mortgages, The Right Choice

Unit 16: Why Go To Work?

Unit 17: Principles of Work

Unit 18: The Dangers of Riches

Your Dashboard you have access to all the Units. Once you click on a unit it opens up the entire task for the units.

The units cover a wide range of topics. Each Unit has videos courses to view. The course is taught by Don Blanton founder of PEM LIFE. There are downloadable PDF’s for reading and several illustrations within the PEM LIFE program and outside links to other resources. Other activities include writing assignments that you submit to be graded. Each Unit has several quizzes. Some of the assignments are using the discussion forum. You have several grading rubrics to assess to help grade your students in several areas.

The lessons are laid out in the same format overall. You will have your Instructor Guide at the top of each unit. Each lesson my son pointed out has a symbol assigned to it. For the videos it looks like a dog-eared paper, the calculators look like a green puzzle piece, PDFs is the normal symbol you’d expect, writing assignments a paper and pen symbol and the reflection post and discussion is a chat symbol. The first assignment is always a video with Don Blanton teaching the topic. Not all the units use the Financial Calculators. The units also vary on how many videos are in each unit. All of them have writing assignments, reflection post and discussion, and a vocabulary and concept quiz.

Answer keys are provided for all the assignments too. You can download them as a PDF file.

Discussions are for open discussions with others doing the course. Your reflection post is always the last task. This is where you can share your thoughts with others in a secure format your thoughts or even questions about the unit.

At your fingertips you have an Interactive Resource Library that has several models that you can add in numbers to get instant feedback in a sort of calculator format and other resources that let you explore many aspects of learning about the Financial Literacy. Example: Federal Tax Liability, Real Time US Debt Clock, Mortgage Down Payments, and Budget Builder. On the Budget Builder you can put in an income and add in other expenses that are build in like food, mortgage, insurance, and other essentials. You can also add in your own expenses. This was an interesting way for my son to see how far your money really goes in all aspects of life. It was an eye opener for him that he could plug in numbers and see results instantly. My son really enjoyed exploring the Interactive Resource Library.

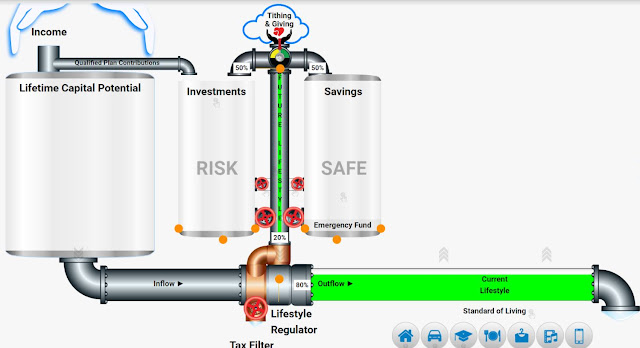

The gem of the course is the Personal Economic Model created by Don Blanton. It's amazing putting in amounts and seeing how the flow of money effects your life in many ways. It's adjustable to make it fit any scenario of finances. Its a reference point of how your money works in many ways. It really lets you see the big picture.

The Instructor Guide is very important to help you navigate through the course. Each unit has an Instructor Guide that has notes and information about your unit to guide you through it. There are assignments if you are using this in a classroom setting. There are also bonus materials within your guide. The units vary time wise depending on how you use the course. I would plan around an hour or more if you are using all the features of the course.

Another feature is that you have two options of how to learn the PEM LIFE and to use the course:

Proctored Path- This would be for a self-led learning by the student. They will move through each unit watching the videos, reading the material, quizzes and assignments. The teacher isn’t involved in teaching but more overseeing and directing them what to do on their own. This still involves all the course content with the videos, homework, reading, and quizzes.

Instructional Path-This involves the teacher using the resources to learn the content and to be more hands-on in presenting the course to your student. There are coaching videos, Power Point presentations, and other resources to help you teach your student. The course doesn’t require you to have prior knowledge of the material to present it to your student.

How Did I Use Personal Finance Illustrated® Homeschool Edition in my Homeschool?

I did this course with my 15 year old son who is in 9th grade. My son likes finances and has a good grasp of it for his young age.

After I got logged in a spent some time looking over the introductions and the units I decided that we would do a mixture of me helping him and him being independent doing the course. My son wanted to start in Unit 1 and work his way through the course. A unit took him a little over a week. I think it was because he was to curious with the resources. I looked and browsed through all the units.

Like I mentioned earlier my son really enjoyed exploring the Interactive Resource Library. He spent a lot of time toying with all the resources. He thought it was interesting seeing the different variables of finances you can plug into them. He played around using different yearly incomes, mortgages, loans, savings, living expenses, and tithing, and other resources to see the outcome. I think he learned a lot with the hands on approach toying with the resources in this area.

He did not use all aspects of the course. He did some of the worksheets and watched all the videos. He didn't do the discussions or the reflection post. He said, "I don't feel I grasp the concepts fully to be able to clarify my thoughts to explain or talk about it." I really think this course would have been more beneficial for him as a Junior or a Senior. He wants to continue the course.

My Thoughts and Recommendation

This is an advanced finance course that would be great for someone who has a good mind for finances, upper high school, and even college level. There were several aspects of this program that where probably over my son’s head. I realize that he is on the younger end of it and I went into to this knowing that some topics would be foreign to him. However he is curious enough to still dig into topics he doesn’t grasp fully. I think he has a good introduction to topics that most college students and adults don’t even understand using PEM LIFE.

I felt a bit overwhelmed with where to start in the program and how to plan a unit. Maybe, I’m spoiled and like things in a already prepared schedule. I would love a schedule. Something that is broken down by days like Monday through Friday schedule for each unit with day 1 you do such and such and so on. I know that I can just use my Dashboard and start with the first thing on the list and work my way down but when I write out my son’s weekly schedule I want a plan already laid out. I want something to download at the beginning before I even begin for all the units together.

Even though each unit has a Teacher Guide at the beginning of each unit and I would still keep that with each unit but also have a Teacher Guide that has all the Units in one PDF also available. That is a time saver for me having to only do a download once.

Another option I would like is an option to have to purchase a physical book for the students. I know several families who struggle with printing and others who don’t want to mess with downloading PDFs.

Personal Finance Illustrated® Homeschool Edition from PEM LIFE is an impressive financial program that goes above and beyond any financial literacy program I’ve seen in the homeschool market. Its really impressive and a lot of heart and thought has been put into this homeschool edition. I think any student who goes through this course will be well prepared in the future to have a firm grip on finances and the many aspects that go into it. It's just not getting a paycheck and paying bills. I sure could have taken a lot out of this course when I was younger. It would have been a great start to a successful financial future.

Other members of the Homeschool Crew Review have been using this also. Click here or on the graphic below.

Search This Blog

Grab my button!

Followers

Homeschool Planet

Popular Posts

-

We are learning about the Viking in our history studies. What better way the enhance the learning by adding a craft to the mix. With my kid...

-

About the Book Boo k: Light To My Path Author: Erica Vetsch Genre: Christian Historical Romance Release Date: February 10, 2026 A de...

-

About the Book Boo k: Ambush of the Heart Author: Mary Connealy Genre: Historical Romance Release Date: February 3, 2026 When bandits...

-

Disclaimer: I received a FREE copy of this product through the HOMESCHOOL REVIEW CREW in exchange for my honest review. I was not required t...

-

Biblical Encouragement for Everyday Motherhood Have you ever whispered to yourself, I’ll be a better mom tomorrow …but tomorrow never c...

0 comments:

Post a Comment

Thank you for visiting my blog.